Selling as an Amazon Seller in the USA (Amazon FBA USA): Your leap across the pond

The idea of working on Amazon USA can be intimidating at first. The US market is huge and holds immense opportunities – but also challenges. In this guide, we’ll show you what you need to look out for and how we SPACEGOATS will help you to master your market entry.

Why you should target the US market (Amazon FBA USA)

The US market is the largest Amazon marketplace the world. Over 50 % of all e-commerce in the USA is conducted via Amazon. For German companies, this means that if you are already successful on Amazon.de, you can potentially more than double your sales by moving to the USA. This not only opens up new sources of income, but also diversifies your business and reduces the risk that can arise from dependence on a single market.

With a separate seller account for Amazon USA you also ensure additional flexibility. Should there be a problem or an account block on the German marketplace, your access to the US market exist.

Preparation is everything: what you need to know before you start

Internationalization requires some preparation. Many retailers ask themselves whether they need a Found an American company to be allowed to sell in the USA. The answer: No, this is not absolutely necessary. A German UG or German limited liability company is sufficient in most cases. Of course, there are advantages and disadvantages that you should weigh up – primarily with regard to product liability and possible tax risks.

Product liability is an important issue in the USA, as the laws are stricter than in Germany. A good first step is to take out product liability insurance to be prepared in the event of an emergency.

The path to product listing: cultural differences and the right strategy

The preparation of offers on Amazon USA is similar to the procedure in Europe. Nevertheless, you should cultural differences should not be underestimated. American customers have different expectations of product texts, images and even the language of the reviews. Make sure that your product descriptions are written in perfect English and that the US tone is appropriate.

An additional tip: Use data and customer feedback from your German Amazon sales to optimize your offer for the US market. With SPACEGOATS we help you to design your listings so that they are culturally and strategically tailored to the US market tailored to the US market.

Logistics and shipping: how to overcome the hurdles

One of the biggest obstacles for many retailers is the goods handling. Your products must be imported into the USA, and you are the seller of the Importer of Record (IOR). It can seem complicated, but with the right partners at your side, it’s doable. Amazon FBA is your best friend here: as soon as your products have reached the USA, Amazon takes over the entire logistics process – from the warehouse to delivery to the customer.

SPACEGOATS completely relieves brands of the challenges of online sales by purchasing products directly in the B2B process and then distributing them in the USA using the Amazon logistics network. Brands don’t have to worry about anything; we take care of the entire process from receiving the goods to selling them on amazon.com.

Tax issues: Sales tax in the USA

One issue that puts many German retailers off is the sales tax in the USA. Unlike in Germany, there is no standardized national value-added tax in the USA. Instead, each state levies its own Value added taxand you are only liable for tax in the states where your stock is located. The good news is: In many states, Amazon already takes care of paying the sales tax for you.

In states where Amazon does not automatically pay sales tax, you may need to register if your sales exceed certain thresholds. Amazon is now paying sales tax in almost every state, and it’s possible that by the time you read this, it’s already the case everywhere. Nevertheless, it is important to know the current status of your tax obligations.

The financial aspect: bank accounts and payment processing

A common question is whether an American bank account is required. The answer: No. You can use the distributions from Amazon USA to your German account transfer. Although exchange fees are incurred, there are ways to minimize these, e.g. by using payment service providers that offer more favourable exchange rates.

Internationalization with a clear plan and the right partners (Amazon FBA USA)

Entering the US market offers enormous opportunities for retailers who want to expand their business internationally. Although the process may seem complex at first, it can be successfully mastered with the right preparation and the right partners. At SPACEGOATS, we not only support you with the preparation of quotations and logistics, but also with important product compliance. Our expertise includes technical support and strategic advice to ensure that your products comply with US regulatory standards and that you can sell successfully on Amazon USA. Let’s take the leap across the pond together and take your international business to the next level!

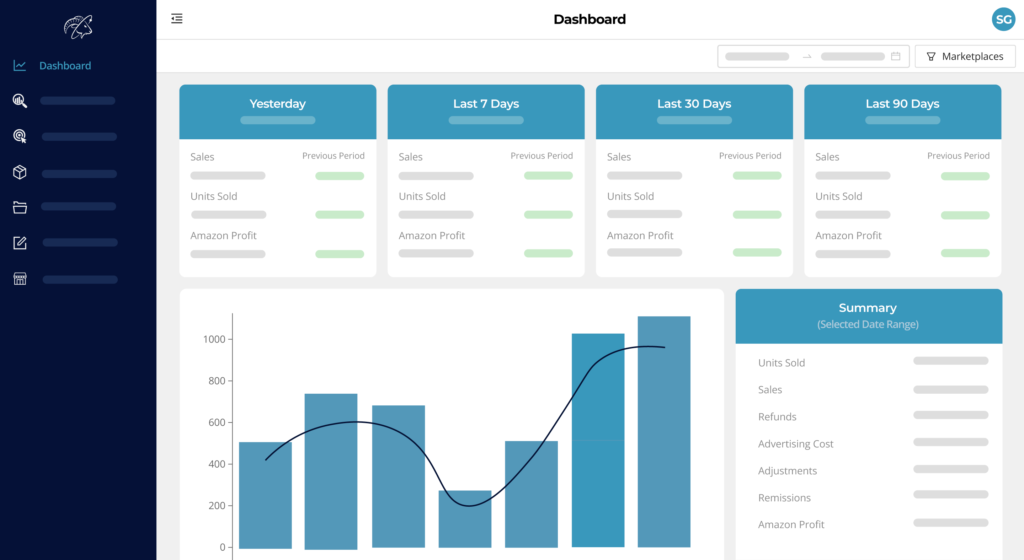

Galaxy introduction video

To give you a better feel for what the Galaxy has to offer, here is a short introductory video:

Pricing

Europe

from € 999

Setup fee

4,9%

Revenue share

from € 999

Monthly minimum fee

all

Features included

Marketplaces included

EN

FR

IT

ES

PL

NL

SE

BE

UK

Setup fee: One-time fee for setting up your GALAXY Account, Onboarding Calls, initial support, and all administrative and operational tasks. We want to make sure that you will get the best and most individual experience and be able to start right away! Compliance check fees are not included.

Revenue share: For all products, SPACEGOATS deducts 4.9% revenue share calculated on the total sales price. The total sales price is the total amount paid by the buyer, including the item price (gross sales). The revenue share applies for every item sold, you will pay SPACEGOATS 4,9% of the total price or a minimum fee, whichever is greater.

Monthly minimum fee: SPACEGOATS charges a 4,9% revenue share with a minimum fee of 999€ /month. If you exceed a monthly revenue of 20.387€ made with SPACEGOATS per account, the minimum fee is reached and the 4,9% applies to further sales.

Marketplaces included: Choose all marketplaces and use the Pan-EU Program, or choose single countries via. Multi-country inventory (MCI). You have the flexibility to choose as many or as few countries as you like. We are able to exclude single marketplaces and still use the Pan-EU Program.

UK Special: Obligatory Label Compliance check to provide you with a UK RP (300£/ Parent ASIN). We take care of the importing process into the UK for you! Extra costs will apply.

US

NEW

from € 999

Setup fee

6,5%

Revenue share

€ 999

Monthly minimum fee

all

Features included

Marketplaces included

US

Setup fee: One-time fee for setting up your GALAXY Account, Onboarding, initial support, and all administrative and operational tasks. We want to make sure that you will get the best and most individual experience and be able to start right away! Compliance check fees are not included.

Revenue Share: For all products, SPACEGOATS deducts 6.5% revenue share calculated on the sales price(net price). The sales price is the amount paid by the buyer, including the item price (net sales price). The revenue share applies for every item sold, you will pay SPACEGOATS 6,5% of the selling price or a minimum fee, whichever is greater.

Monthly minimum fee: SPACEGOATS charges a 6,5% revenue share with a minimum fee of 999€ /month. If you exceed a monthly revenue of 15.369,23€ made with SPACEGOATS per account, the minimum fee is reached and the 6,5% applies to further sales.

Marketplaces included: Only the US marketplace is included in this pricing package. You can also combine packages.